Talking Points:

- EUR/USD FX Crowd Remains Net-Short Despite Bullish Breakout.

- GBP/USD at Risk of Further Headwinds on Mixed U.K. Data.

- USDOLLAR Carves Bullish Formation Ahead of Fed Testimony.

For more updates, sign up for David's e-mail distribution list.

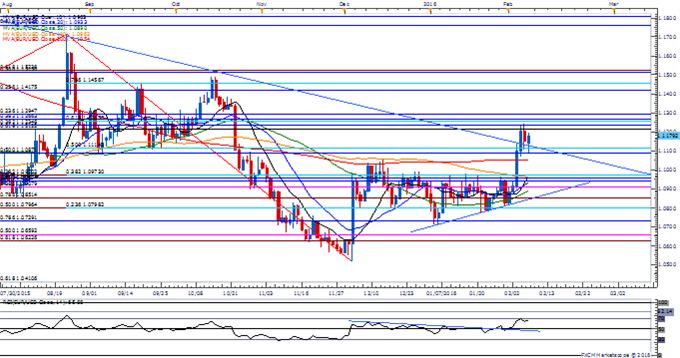

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

- With EUR/USD breaking out of the downward trend carried over from the end of 2014, the pair stands at risk of a further advance especially as the Relative Strength Index (RSI) fails to retain the bearish formation from December.

- Even though the European Central Bank (ECB) keeps the door open to further embark on its easing cycle, the euro-dollar may continue to pare the decline from the August high (1.1713) as it breaks out of the range-bound price action from earlier this year; will keep a close eye on former resistance around 1.1052 (November high) to 1.1090 (50% retracement) as it appears to be offering near-term support.

- The DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-short EUR/USD since February 1, but the ratio remains off of recent extremes as it narrows to -1.62, with 38% of traders now long.

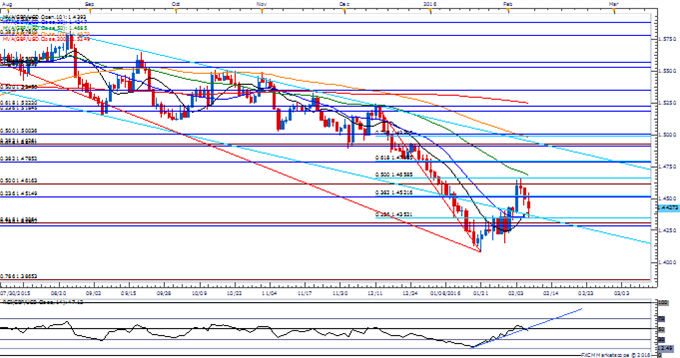

GBP/USD

- GBP/USD stand at risk of facing further headwinds as U.K. Manufacturing is expected to rebound 0.1% in December, while industrial outputs are projected to decline another 0.1% during the same period; mixed data prints may continue to push out bets for a Bank of England (BoE) rate-hike following the unanimous vote to retain the current policy in February.

- The near-term rebound in Cable appears to be getting exhausted as the RSI struggles to preserve the bullish formation from earlier this year; RSI trigger may highlight 1.4620 (50% expansion) to 1.4660 (50% retracement) as near-term resistance.

- A break/close below 1.5350 (23.6% retracement) may spur a move back towards the 2016 low (1.4078) as BoE Governor Mark Carney & Co. appear to be in no rush to normalize monetary policy.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

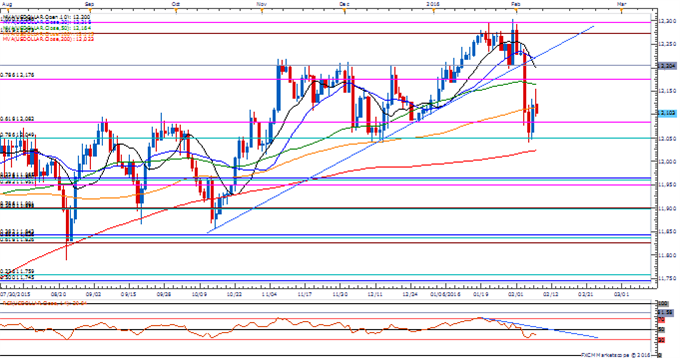

USDOLLAR(Ticker: USDollar):

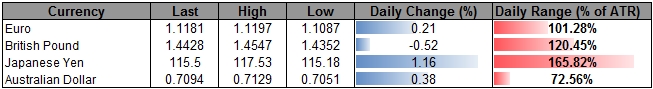

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 12103.26 | 12156.58 | 12097.01 | -0.16 | 108.45% |

Chart - Created Using FXCM Marketscope 2.0

- Even though the USDOLLAR struggles to hold its ground, the recent series of higher highs & lows may generate a larger recovery over the days ahead as the greenback appears to be finding near-term support around 12,049 (78.6% retracement) to 12,082 (61.8% expansion).

- The semi-annual Humphrey-Hawkins testimony with Fed Chair Janet Yellen takes center stage as market participants weigh the outlook for monetary policy, but we may get more of the same from the central bank head as the U.S. Non-Farm Payrolls (NFP) report shows a further improvement in labor dynamics.

- May see a similar price action to December amid the failed attempt to break/close below 12,049 (78.6% retracement) to 12,082 (61.8% expansion), with the topside region of interest coming in around 12,176 (78.6% expansion) to the 12,200 pivot.

Read More:

EUR/USD Bullish Interpretation is Valid While above 1.1050

February Seasonality Gives US Dollar Rebound Hope Next Few Weeks

USD/CAD – The Unwind of “Negative Irrational Exuberance”USD/JPY-Don’t Forget about the 26 Year Trendline

Get our top trading opportunities of 2016 HERE

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

original source