|

Monday March 2 | Weekly market update |

| Financial markets have just experienced their worst week since the end of 2008, panicked by the clear spread of the coronavirus across the globe and its future global economic repercussions. Risk aversion has therefore clearly resurfaced, as has the VIX, which rose by more than 250% over the past week (from 17 to 45). |

| Indexes For the indices, it was a terrible week, regardless of the geographical area mentioned. In Asia, the Nikkei lost 6.1%, the Hang Seng 4.3% and the Shanghai Composite 5.2%. The balance sheet is even heavier in Europe, with the CAC40 down 12.7% for the week. The DAX also fell by 13.1% and the Footsie lost 11.8%. For the peripheral countries of the euro zone, Italy, Spain and Portugal lost 12.1%, 13% and 12% respectively. The situation is identical in the United States, with the Dow Jones recording a weekly loss of 14.5%. The S&P500 fell by 13.9% and the Nasdaq100 by 13.1%. Strong push of the Vix  |

| Commodities The week was relatively turbulent in the commodity markets due to the increasing number of coronavirus outbreaks around the world. Oil markets were strongly impacted downwards. Fears about global oil demand have intensified, while OPEC+ has still not reached a consensus on how to deal with the spread of the coronavirus. WTI is down to USD 46 per barrel while Brent is flirting with the USD 50 mark. Precious metals did not escape the stock market slump. Traders take their profits on gold and silver, favouring liquidity to hedge their portfolios. The gold metal is losing ground at USD 1620. Silver dropped to USD 17.1. The base metal segment continues to suffer. Copper fell 2% to USD 5618, aluminium recorded a new annual low at USD 1670, as did zinc, which fell below USD 2000. |

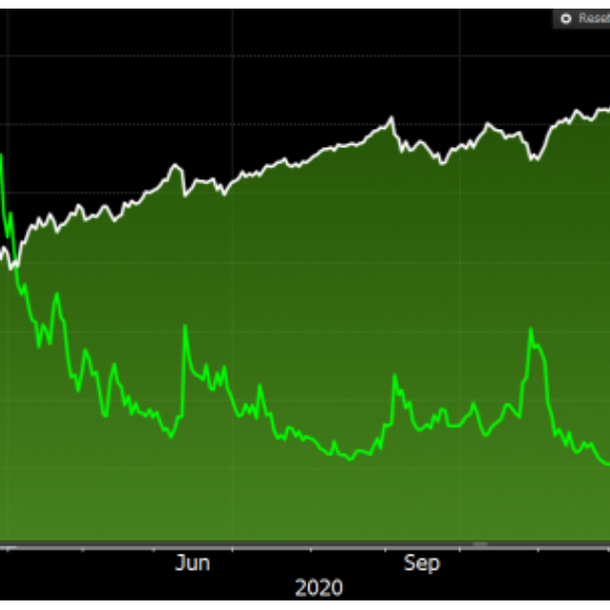

| Equities markets Iberdrola Iberdrola is one of Spain's largest gas and electricity producers, as well as the world leader in wind energy. The Spanish company is one of the defensive stocks that are behaving better than the market as a whole. Its 2020 track record of +15% attests to this. The 2019 results were generally in line, but the 2020 guidelines have been raised as well as those of 2021 and 2022, which are rare in these times. The Hispanic group published an annual net profit of 3.4 billion euros (+13%) backed by an Ebitda of 10.1 billion (+8.1%). The analysts who follow the dossier raise their expectations of BNA to +6.2%. The company has a long history, having been in existence since 1840, at a time of maximum energy supply needs. It benefits from the energy industry's enthusiasm for decarbonisation. The planned growth is essentially organic, as the group does not intend to acquire other entities, even in geographically relevant areas. Graphs of Iberdrola and its ratio with the Stoxx600  Blank: Iberdrola share price evolution In green: ratio with the Stoxx 600 showing the outperformance of the Iberdrola share. |

| Bond market On the bond market side, the repercussions of the spread of the virus across the globe are being felt in the yields on government treasuries. The majority of them are falling again, particularly the T-Bond, which has reached a new historical record of 1.20% (see graph). In Europe, bond benchmarks are moving more erratically. The Bund's yield fell to -0.59% and that of the French OAT to -0.28%. On the other hand, spreads widened significantly compared to Italy (1.16%) or Greece (1.3%). It is true that profit-taking probably still plays a major role in this context, given that debt instruments from the periphery have performed well over the past year. But one is nevertheless forced to conclude that there is some flight to quality. Swiss debt is still in great demand, causing its rate to fall to -0.87%. The low interest rate environment has led many investors to lower the quality of the bonds held in their portfolios in order to benefit from more attractive yields. This wave of low-quality new issues enabled investors to find the necessary liquidity but also substantially increased risk. With the slowdown in the global economy, these same companies could see their credit quality deteriorate, implying a downgrade in their credit ratings and therefore a forced sale to remain in line with the investment policy of the various funds. To be continued... Historic low of 10-year US yield  |

| Forex market The dollar has seen a strong sell-off, following the collapse of equity indices in Wall-Street. Speculation remains intense about the Fed's interest rate strategy. Stakeholders are anticipating a further rate cut of up to two in 2020. These expectations could rise further, depending on health risks. The EUR/USD is trading around 1.10 USD (+200 basis points). The single currency is becoming a kind of default safe haven as the Swiss franc is also losing ground at CHF 1.06, with the first cases of contamination in Switzerland. The euro is also gaining ground against sterling at GBP 0.85, after the British government threatened to slam the door on post-Brexit negotiations due to lack of rapid progress. Forex traders are looking for opportunities and have been trading the yen higher, as the USD/JPY fell 300 basis points. Volatility that has been absent for months is returning to the forex market. |

| Economic data Given the current situation, it seems almost pointless to take a look at the data and the calendar of events. The dominant issue is the coronavirus, with the resulting high degree of uncertainty for the economic outlook and, related to that, for the policy response of central banks. Nevertheless, a few figures have fuelled the statistical calendar as in Germany, with the IFO up 0.1 points to 96.1 or GDP stable. Growth in the United States reached 2.3% in 2019 against 2.9% in 2018, as companies slowed down their investments. Nevertheless, growth remains solid compared to the major European countries. In the fourth quarter of 2019, GDP grew by 2.1% (unchanged from the third quarter). Also across the Atlantic, the Conference Board's consumer confidence index was unveiled, with the gauge marking 130.7 compared with the expected 132.6. For the first time since the outbreak of the virus in December 2019, the IMF has revised downwards its global growth forecasts for 2020. The institution's economists estimate the impact at 0.1 point of growth in the world. In January, they expected global GDP to grow by 3.3% in 2020, compared to 2.9% in 2019. |

| The virus of fear The market is in panic.Indices suddenly went into "spin" mode as investors became aware of the spread of the epidemic. The market can "take" risk but not uncertainty, hence the massive outflow of equities in favor of quality government bonds, such as the 10-year US 10-year benchmark, with its historically low yield. Market participants are playing off a sharp downturn in economic activity in the form of a negative supply shock (disruption of the supply chain) to which a shock, this time of confidence, could be superimposed at a time when growth was beginning to show signs of weakness. Worries are piling up at a time when the tools of central banks (the pillars of index-linked growth for the past ten years) are not necessarily adapted to this type of situation. |

By

By