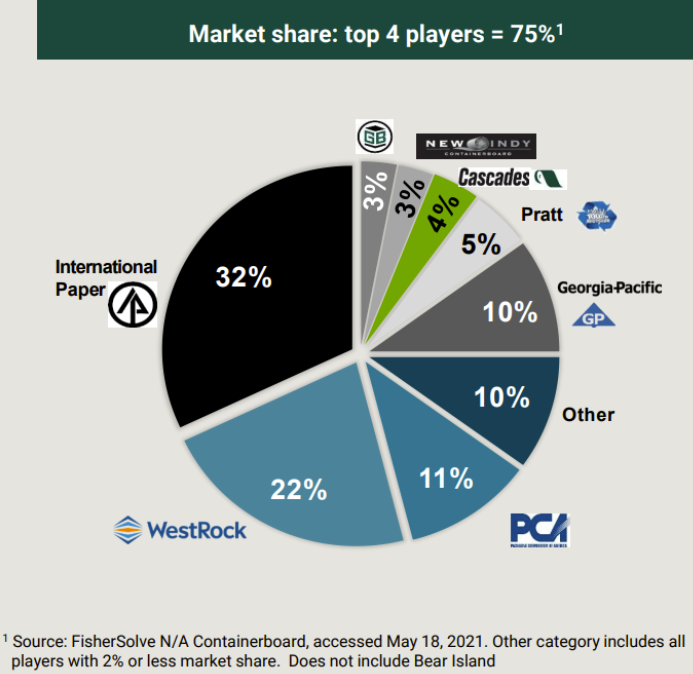

The packaging sector is dominated by four major players in the United States, which together control over 75% of the market -International Paper, WestRock, Packaging Corporation and Georgia-Pacific.

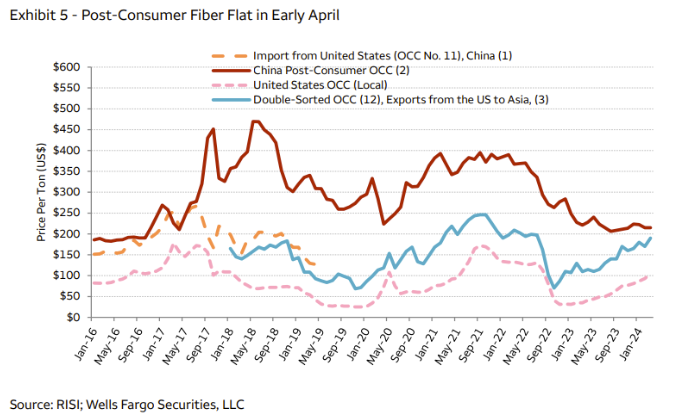

In 2023, after two years of post-COVID recovery, the packaging industry experienced a 5% drop in demand, leading to overstocking and a drop in prices of over 70%. According to a Wells Fargo note, early estimates for 2024 point to a recovery in demand, and with it rising prices, and a return to full plant capacity. The sector anticipates a strong recovery in the second half of 2024.

Prices return to historical average levels

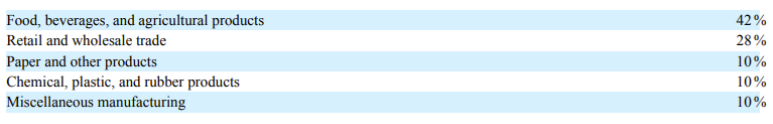

PCA's core business is the production of corrugated board, accounting for 91.4% of sales. These products are destined for a variety of industries, including food, beverages, industrial and consumer products.

Paper, including office, communication and printing papers, accounts for 7.6% of sales. By 2023, 61% of this segment's revenues will come from collaboration with ODP Corporation (formerly Office Depot).

The remaining percentage corresponds to operational aspects of the business, such as transporting assets to production sites.

The majority of revenues - 94.8% - come from its domestic market, the United States. The remaining 5.2% is generated internationally.

End markets for corrugated board products in the USA, according to the Fibre Box Association's 2022 annual report.

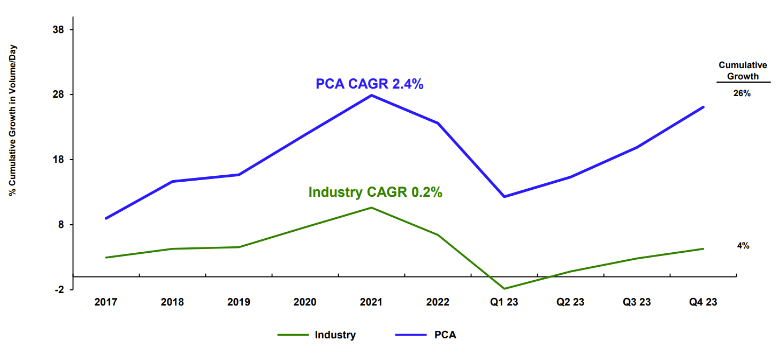

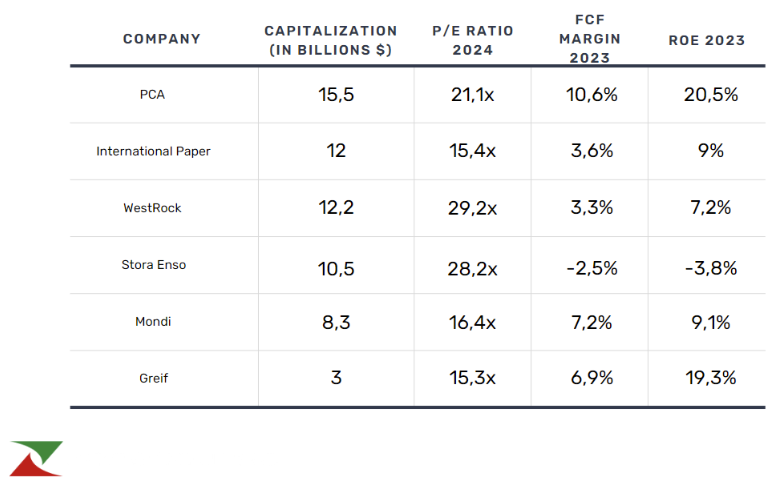

With a market capitalization of $15 billion, PCA leads its sector. Its price/earnings ratio has reached 21.1x this year's expected figures, a high valuation which is explained by the company's ability to generate above-average growth in the sector.

Despite a decline in sales to $7.8 billion in 2023. PCA's free cash flow margin is the highest in its sector, at 10.6%.

This financial performance enables PCA to return cash to shareholders, with a payout ratio of 38%. In figures, this translates into $2.9 billion in dividends, with an average annual growth rate of 15.2% over fifteen years, and $1 billion in share buybacks, reducing the number of shares outstanding by 8.5% over the last ten years.

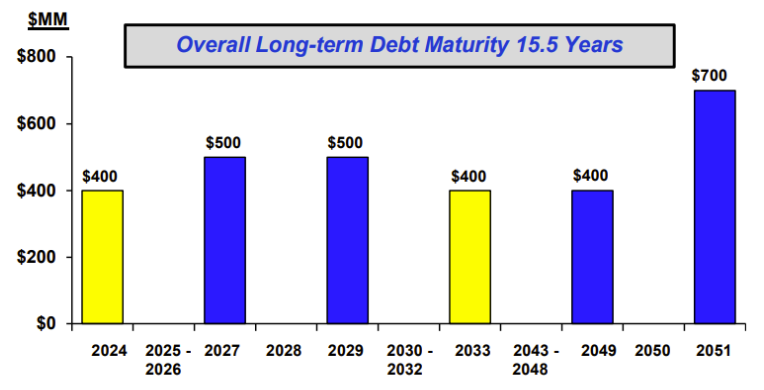

PCA also boasts the lowest debt leverage in its industry-which has been steadily improving since 2017. With $2.4 billion in debt staggered to 2051 and $1.2 billion in available cash, PCA has a robust capital structure and good financial leeway.

Outlook for 2024

At its first-quarter 2024 earnings conference, Packaging Corporation of America announced that it expects sales to improve for the year, despite certain challenges in its business segments.

In the paper sector, the company is forecasting a slightly lower-than-expected average price, with a reduction in margins of 120 basis points in the fourth quarter of 2023. This decline is attributed to lower demand due to increased digitization in the professional sector.

In its core business - corrugated board - a drop in production is expected in the first half of the year due to maintenance at one of its plants. To compensate, PCA is expected to relaunch another production site, anticipating a return to normal and an increase in sales for the second half of 2024.

By way of comparison, here's a table showing PCA's main competitors listed on the stock exchange:

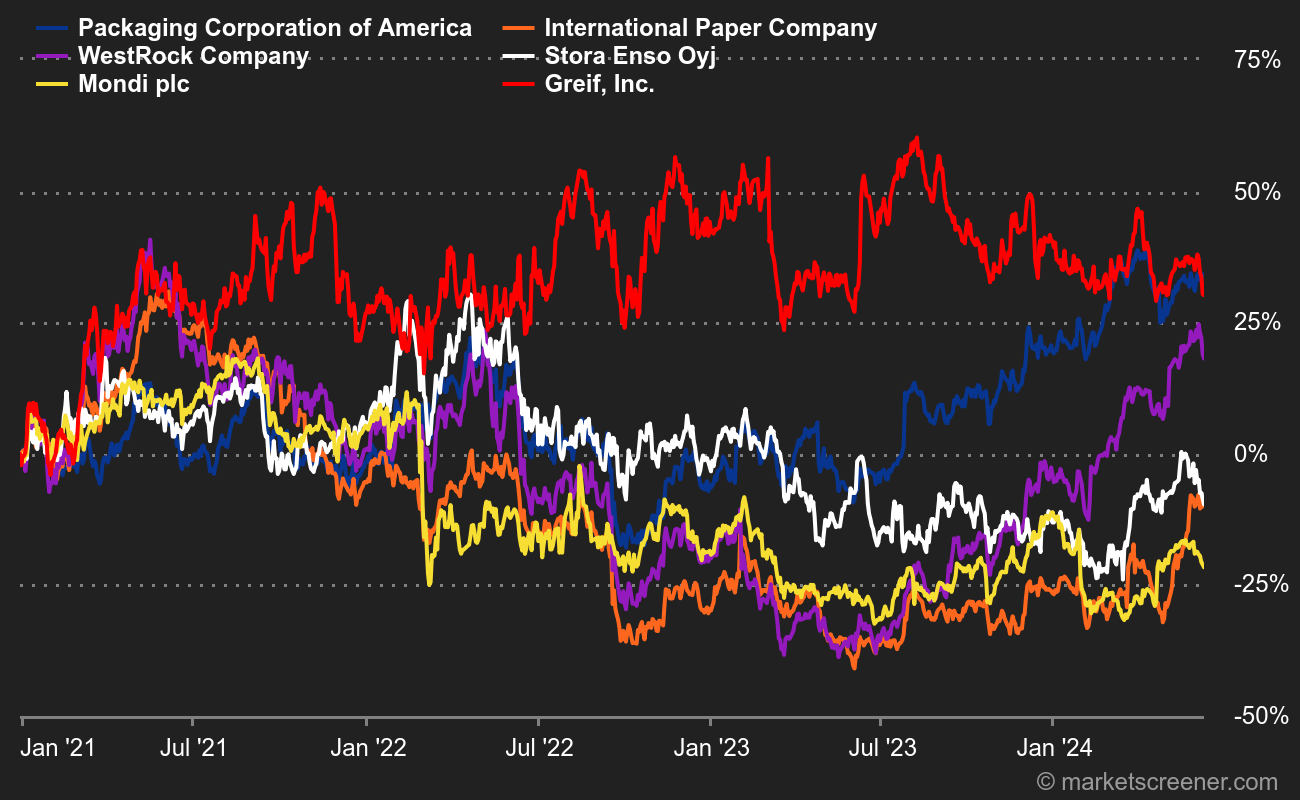

Since the COVID crisis, PCA has been one of the best-performing stocks in its industry.

By

By