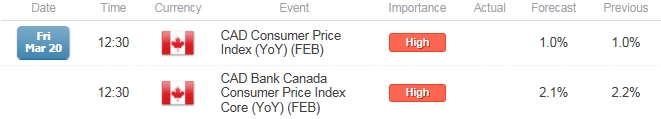

- Canada Consumer Price Index (CPI) to Hold at Annualized 1.0% for Second-Month.

- Core Inflation to Slip to 2.1%- Slowest Pace of Growth Since November 2014.

Trading the News: Canada Consumer Price Index (CPI)

Another contraction in Canada Retail Sales paired with a slowdown in the core Consumer Price Index (CPI) may trigger a near-term breakout in USD/CAD as it fuels speculation for another Bank of Canada (BOC) rate cut in 2015.

For more updates, sign up for David's e-mail distribution list.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Indeed, a slew of dismal developments may heighten the bearish sentiment surrounding the Canadian dollar and push BoC Governor Stephen Poloz to adopt a more dovish tone for monetary policy as the central bank increases its efforts to mitigate the risks surrounding real economy.

Expectations: Bearish Argument/Scenario

Release | Expected | Actual |

Wholesale Trade Sales (MoM) (JAN) | -0.8% | -3.1% |

Manufacturing Sales (MoM) (JAN) | -1.2% | -1.7% |

Retail Sales (MoM) (DEC) | -0.8% | -2.3% |

Canadian firms may continue to offer discounted prices amid the weakness in private-sector consumption, and a sharp slowdown in price growth may generate fresh monthly highs in USD/CAD as it puts increased pressure on the BoC to further reduce the benchmark interest rate.

Risk: Bullish Argument/Scenario

Release | Expected | Actual |

Net Change in Employment (FEB) | -5.0K | -1.0K |

Gross Domestic Product (Annualized) (4Q) | 2.0% | 2.4% |

Gross Domestic Product (YoY) (DEC) | 2.5% | 2.8% |

Nevertheless, the ongoing recovery in the labor market along with prospects for a stronger recovery may generate sticky price growth in Canada, and a batch of better-than-expected data may keep the dollar-loonie capped over the near-term especially as the Federal Reserve pushes out its interest rate forecast.

For LIVE SSI Updates Ahead of Canada’s Inflation Report, Join DailyFX on Demand

How To Trade This Event Risk(Video)

Bearish CAD Trade: Core Inflation Slips to 2.1% or Lower While Consumption Contracts

- Need green, five-minute candle following a series of dismal data to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish CAD Trade: Retail Sales, CPI Exceeds Market Expectations

- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

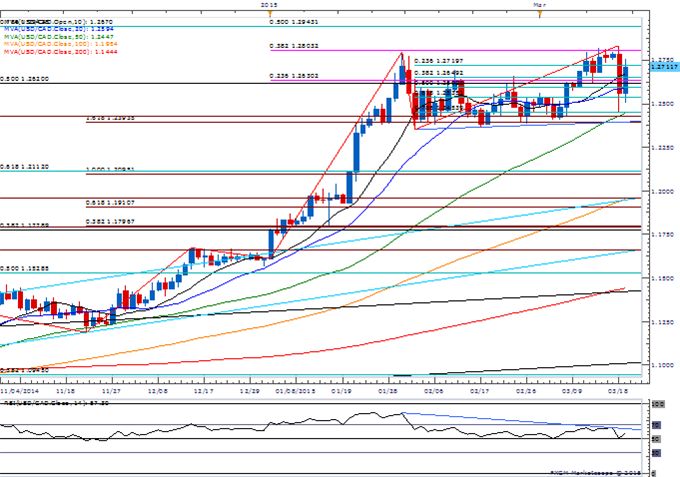

Potential Price Targets For The Release

USD/CAD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

- Need a break of the bearish RSI momentum along with a close above the 1.2800 handle to favor a resumption of the long-term bullish trend in USD/CAD.

- Interim Resistance: 1.2800 (38.2% expansion) to 1.2833 (March high)

- Interim Support: 1.2390 (161.8% expansion) to 1.2430 (161.8% expansion)

Read More:

GBPCAD at Support- Scalps Target 1.8785 Ahead of Key Data

GBP/USD Holds 1.47 Support Despite Dovish BoE- Divergence Takes Shape

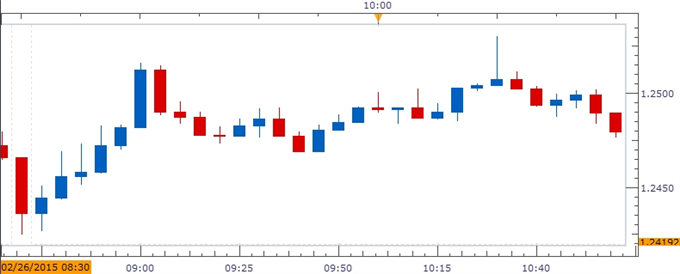

Impact that the Canada CPI report has had on CAD during the last month

Period | Data Released | Survey | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

JAN 2015 | 02/26/2015 13:30 GMT | 0.8% | 1.0% | -21 | +46 |

January 2015 Canada Consumer Price Index (CPI)

Canada’s Consumer Price Index (CPI) slowed for the third consecutive month in January, with the headline reading slipping to an annualized 1.0% to mark the lowest print since November 2013. At the same time, the core rate of inflation unexpectedly held steady at 2.2% for the second-month, and the stickiness in price growth may encourage the Bank of Canada (BoC) to retain its current policy throughout 2015 following the surprise rate cut at the January 21 meeting. Despite the stronger-than-expected CPI prints, the Canadian dollar struggled to hold its ground following the release, with USD/CAD climbing above the 1.2500 handle to end the day at 1.2511.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source