Talking Points

- EUR/USD at important “time” resistance

- USD/CAD touches highest level in 4 and a half years

- S&P 500 at a key near-term inflection point

Looking for real time Forex analysis throughout the day? Try DailyFX on Demand.

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: EUR/USD

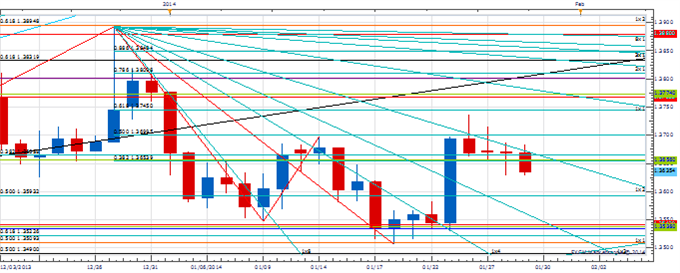

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD has moved modestly lower since failing last week just below the 61.8% retracement of the December/January range at 1.3745

- Our near-term trend bias is lower while below 1.3775

- The 1.3540 level is a key near-term downside pivot with a daily close below needed to signal the start of a new leg lower in the exchange rate

- A turn window is seen over the next day or two

- Only a close over 1.3775 would turn us positive on the Euro

EUR/USD Strategy: We like the short side while below 1.3775.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | *1.3540 | 1.3590 | 1.3635 | 1.3700 | *1.3775 |

Price & Time Analysis: USD/CAD

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/CAD traded to its highest levels since July of 2009 on Wednesday

- Our near-term trend bias is higher in Funds while above 1.1030

- A Gann angle line related to last year’s low near 1.1170 is interim resistance, but the next important upside attraction looks to be the 50% retracement of the 2009/2011 deceline near 1.1240

- The next important cycle turn window is around the second half of next month

- Only a daily close below this week’s low at 1.1030 would turn us negative on Funds

USD/CAD Strategy: We like the long side while over 1.1030.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/CAD | *1.1030 | 1.1100 | 1.1150 | 1.1170 | *1.1240 |

Focus Chart of the Day: S&P 500

Today promises to be an important day for “risk” with the FOMC decision later today. The S&P 500 in particular is in an interesting spot following last week’s sharp downside reversal just before the start of an important cycle turn window on January 24th. The jury is still out in determining what will come out of this important two week period, though a low is now more of possibility following the price action of the past week. Key support levels are the 38% retracement of the October to January advance at 1773 and the 2nd square root relationship of the all-time high near 1760. If the decline of the past few days has just been a healthy correction then these levels really need to hold. Important near-term resistance is seen at the 50 and 61.8% retracements of month-to date range between 1812 and 1821 with traction above needed to relieve immediate downside pressure. A daily close in the index below 1760 would likely be extremely negative for the index.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

original source

By

By