In classic portfolio management theory, we recommend a 60/40 allocation, i.e. 60% exposure to equities (such as the S&P 500) and 40% to bonds. The underlying logic is to rely on bonds to cushion any fall in equities, as these two asset classes are expected to move in opposite directions.

As with any theory, there are exceptions, and those who had (are) positioned on this type of allocation for several years, or even solely on bonds under the "good" advice of their bankers, are now experiencing significant capital losses. This is due to the interest-rate environment, which, after falling for over 40 years, has turned upwards due to high inflation. Bonds were therefore unable to play their role as a shock-absorbing cushion, any more than they were able to offset the decline during the Covid episode.

Is rate easing good for equities?

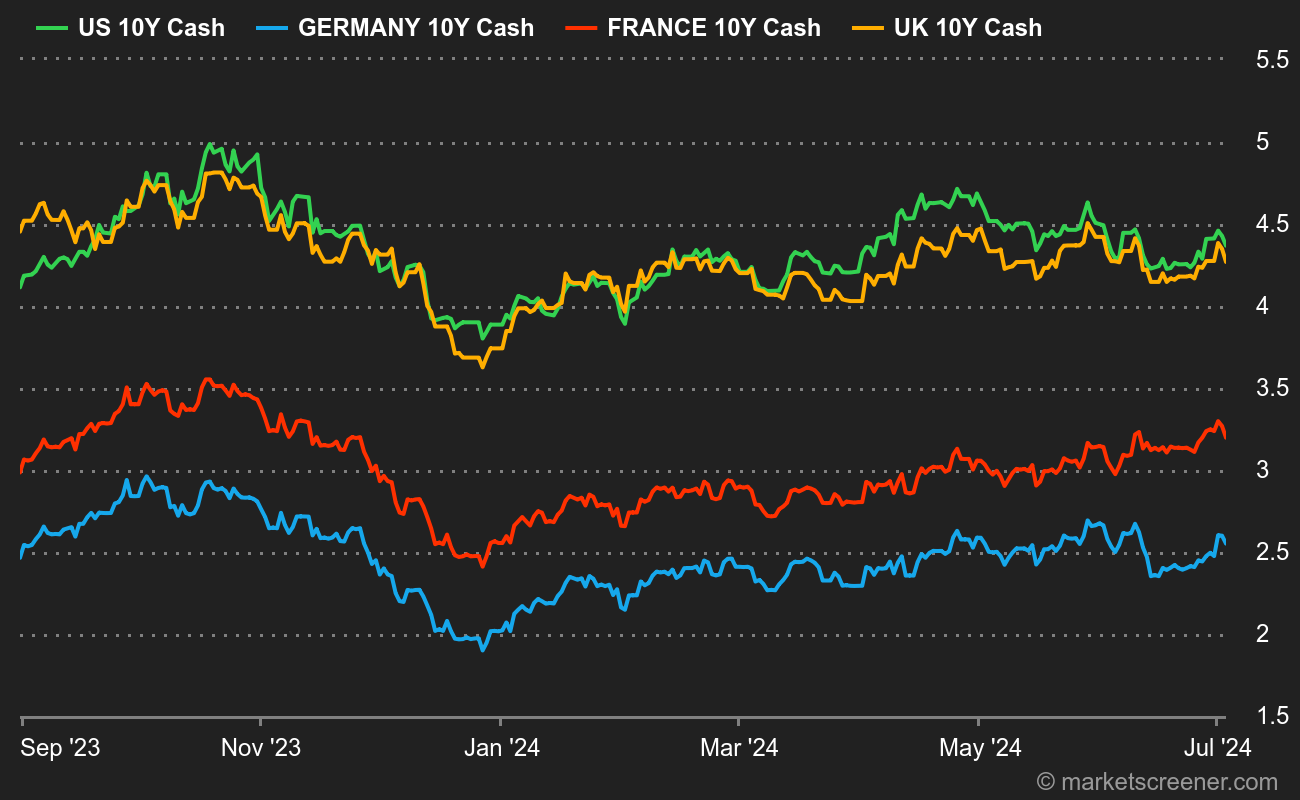

Since 2022, rising interest rates have undeniably weighed on equity market performance. Logically, therefore, any further easing of rates since early November should be accompanied by a rise in equities. PROVIDED, however, that this does not reflect the risk of a contraction in economic activity. Why not? When investors anticipate a recession, they bet on a (future) rate cut by central banks, propelling yields down on the market.

We'll be keeping a close eye on the US 10-year yield over the coming weeks. Further easing must be accompanied by a rise in the S&P 500. Should this not be the case, you can conclude that fears of a recession are re-emerging. The corollary will be a shift in focus from rates to corporate earnings forecasts, given that any deterioration is rarely good news for your capital gains.

S&P 500

S&P 500  By

By