- Australia Employment to Increase for Second Month; Jobless Rate to Hold at 5.8%

- Job Growth Exceeded Market Forecast in November, Led by Full-Time Employment (15.5K)

Trading the News: Australia Employment Change

The AUDUSD may face a larger correction over the near-term as the Australian economy is expected to add another 10.0K jobs in December.

What’s Expected:

Time of release: 01/16/2013 0:30 GMT, 19:30 EST

Primary Pair Impact: AUDUSD

Expected: 10.0K

Previous: 21.0K

DailyFX Forecast: -5.0K to 15.0K

Why Is This Event Important:

Indeed, a further pickup in job growth may present the Reserve Bank of Australia (RBA) with a greater argument to move away from its easing cycle, and the AUDUSD may face a larger rebound should Governor Glenn Stevens talk down bets for another rate cut.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

HIA New Home Sales (MoM) (NOV) | -- | 7.5% |

Retail Sales (MoM) (NOV) | 0.4% | 0.7% |

Company Operating Profit (QoQ) (3Q) | 1.0% | 3.9% |

The ongoing expansion in private sector consumption may prompt firms to further expand their labor force, and a larger-than-expected rise in employment may encourage the RBA to soften its dovish rhetoric for monetary policy as growth prospects improve.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

ANZ Job Advertisements (MoM) (DEC) | -- | -0.7% |

AiG Performance of Services Index (DEC) | -- | 45.1 |

AiG Performance of Manufacturing Index (DEC) | -- | 47.6 |

However, the persistent slack in business outputs may drag on hiring, and a dismal jobs print may heighten bets for additional monetary support as the region continues to face an uneven recovery.

How To Trade This Event Risk(Video)

Bullish AUD Trade: Australia Adds 10.0K Jobs or More

- Need green, five-minute candle following the print to consider a long Australian dollar trade

- If market reaction favors a long trade, buy AUDUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish AUD Trade: Job Growth Misses Market Expectations

- Need red, five-minute candle to favor a short AUDUSD trade

- Implement same setup as the bullish Australian dollar trade, just in opposite direction

Potential Price Targets For The Release

AUDUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- Near-Term Correction Remains in Focus; Lower High in Place?

- RSI Threatening Bullish Trend; Break of Support to Highlight Downside Targets

- Interim Resistance: 0.9250 (23.6% retracement) to 0.9290 Pivot

- Interim Support: 0.8800 Pivot to 0.8810 (38.2% expansion)

Impact that the change in Australia Employment has had on AUD during the last month

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

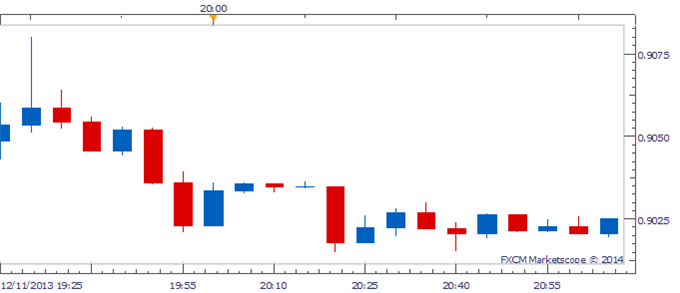

NOV 2013 | 12/11/2013 00:30 GMT | 10.0K | 21.0K | -26 | -118 |

November 2013 Australia Employment Change

Employment increased 21.0K in November following an unexpected 0.7% drop the month, while the jobless rate climbed to an annualized 5.8% from 5.7% as discouraged workers returned to the labor force. The market reaction was short-lived as the AUDUSD quickly pulled back from 0.9080, and the higher-yielding currency continued to lose ground throughout the day as the pair closed at 0.8935.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

By

By