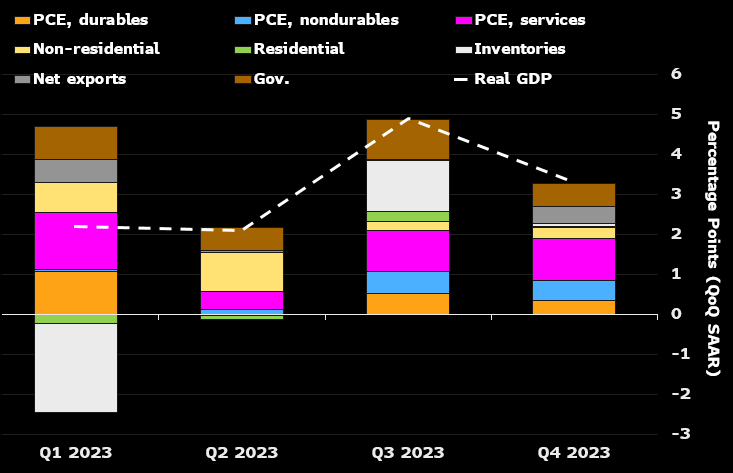

In the meantime, U.S. activity indicators yielded a number of pleasant surprises. On the one hand, US GDP rose by 3.3% in the fourth quarter, against a forecast of 2%, reinforcing the scenario of a soft landing for the economy. On the other hand, the PMI indexes for manufactured goods came out of the red zone at 50.30, against a forecast of 47.60. As for the services component, it remained afloat above the 50 to 52.9 mark, thereby warding off the risk of a recession.

Finally, on the inflation front, things are also calming down, with the seasonally-adjusted Core PCE coming out in line with expectations at 0.2% in December, versus a previous estimate of 0.1%.

Buoyed by this fine momentum, the US stock market's flagship index, the S&P 500, recorded new all-time highs, while the US 10-year yield held below first resistance around 4.23/4.25%. It should be remembered that only a breach of this level will enable us to reach 4.40/43%.

By

By