Block 1: Essential news

Is Binance helping Russians circumvent sanctions?

The platform is suspected of enabling Russian citizens to circumvent Western sanctions. According to the Wall Street Journal, Binance has facilitated money transfers from sanctioned Russian banks, despite its claims to the contrary. The Bank of Russia claims that Binance helped transfer around $428 million between October 2022 and March 2023. Although Binance denies these accusations, certain elements, such as financial flows in stablecoins and testimonies from "Binance Angels", suggest otherwise. As a reminder, Binance is also under investigation by the US Department of Justice.

La Poste: an NFT stamp

Postal company La Poste in France has announced the release of its first non-fungible token (NFT) stamp on September 18. Each purchaser of this NFT stamp will also receive its physical twin and benefit from an "unprecedented digital experience". The initiative, which is part of a move towards Web3, offers a digital wallet on the NFTimbre platform for ordering physical stamps.

Money falls from the sky in Thailand

Thailand's Pheu Thai party will distribute 10,000 baht (approx. $280) in central bank digital currency to every Thai citizen over the age of 16. This distribution, equivalent to 16 billion dollars, requires that recipients spend the money within 6 months and within 4 kilometers of their residence. Although the party sees this as a way of stimulating the economy, critics suggest that it could increase inflation and that the measure is an indirect way of buying votes.

Bankman-Fried complains in custody

On Tuesday August 22, former FTX CEO Sam Bankman-Fried pleaded not guilty to charges of fraud, money laundering and witness tampering at a hearing held in Manhattan court. The charges include embezzling funds from FTX customers for political donations and bribing Chinese officials. In custody, he complained of poor nutrition not suited to his vegan diet and the unavailability of his medication needed for his attention deficit disorder and depression. The judge promised to look into his health and diet problems.

Block 2: This week's Crypto Analysis

On Monday, Binance, the platform that needs no introduction, ran into a PR problem when an ill-advised message was published on X (RIP Twitter). The message, now deleted, insinuated that the platform had suspended all euro transactions, which obviously didn't reassure European users.

But no, Binance's operations in Europe have not been curtailed. Paysafe Payment Solutions, their main banking partner on the continent, has assured us that transactions (deposits and withdrawals) processed by the intermediary in euros (SEPA) will continue without interruption until September 25. This corresponds perfectly to Paysafe's previous statement in June, which revealed its decision to discontinue its partnership with Binance following a "strategic review".

This miscommunication may have highlighted the ramifications of public miscommunication. But what happens after September 25? Although the company assures us it will "find alternatives by then", it's not a foregone conclusion for Changpeng Zhao, the platform's CEO.

To tell you the truth, Binance is facing regulatory hurdles in the UK, is being thoroughly investigated in France, and is encountering growing reservations from countries such as the Netherlands, Germany and Cyprus. Let's face it, things go wrong when you have financial problems in Cyprus, a hot spot for tax evasion and financial opacity in Europe. Given this growing skepticism, it's plausible to assume that potential collaborators will be reluctant to form an alliance with the platform.

Further complicating matters for Binance are the looming legal confrontations in the USA. The platform is facing lawsuits from heavyweight regulators such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Their only glimmer of hope seems to be the Department of Justice's (DOJ) reluctance to impose heavy criminal charges related to money laundering, perhaps for fear of undermining the volatile crypto-asset market.

While the general prevailing industry sentiment is that Binance will navigate these tumultuous waters, there is undeniably a scourge wave of skepticism. A feeling of doubt often referred to as "FUD - Fear, Uncertainty and Doubt" by Changpeng Zhao, or CZ.

In case you missed it, CZ regularly used the number "4" in his social media posts. The number dates back to a tweet in which CZ outlined Binance's three overriding objectives: 1. foster education; 2. ensure compliance; 3. strengthen product and service offering. But he added a fourth point, which can be read on the Binance Blog but also directly on Zhao's X profile: 4. "Ignore FUD, fake news, attacks, etc."

Will try to keep 2023 simple. Spend more time on less things. Do's and Don'ts.

— CZ 🔶 Binance (@cz_binance) January 2, 2023

1. Education

2. Compliance

3. Product & Service

4. Ignore FUD, fake news, attacks, etc.

In the future, would appreciate if you can link to this post when I tweet "4". 🙏

While the first three points are easily understood in the context of a company's marketing communications, the last one is perplexing.

No fear. No uncertainty. And don't even think about doubt. But where my brain tilts is on the "etc", which, in my opinion, opens the door to other prohibitions, all other imaginations and things to avoid according to the platform's CEO. But don't get too imaginative, or CZ might respond with the following message:

4

— CZ 🔶 Binance (@cz_binance) August 2, 2023

CZ has been, and still is for many, revered for its transparency and authenticity, including providing candid information and opinion on a plethora of decentralized platforms and protocols.

However, as the weight of responsibility and PR challenges mount, some feel that a shift towards a more calculated and restrained communications strategy may be in order. Sam Bankman-Fried, also once active on Twitter, learned this the hard way when he realized that his old habit of lying wouldn't bring FTX back.

In the end, what goes around comes around. In recent years, Binance has moved very, very fast in terms of market penetration. Today, it is reaping what it has sown by trying to work with regulators it has long ignored... While its evolution is undeniably remarkable, there remains a current of skepticism, rooted in the platform's past transgressions.

The general consensus is clear: if Binance is to maintain its hegemony in the cryptocurrency arena, it is imperative that it directly addresses and resolves its issues with the law. This includes being transparent about CZ's role in the future, establishing a definitive headquarters for the company and elucidating its immediate and long-term strategy for Europe. In the absence of this clarity, Binance's trajectory remains fraught with questions and uncertainties.

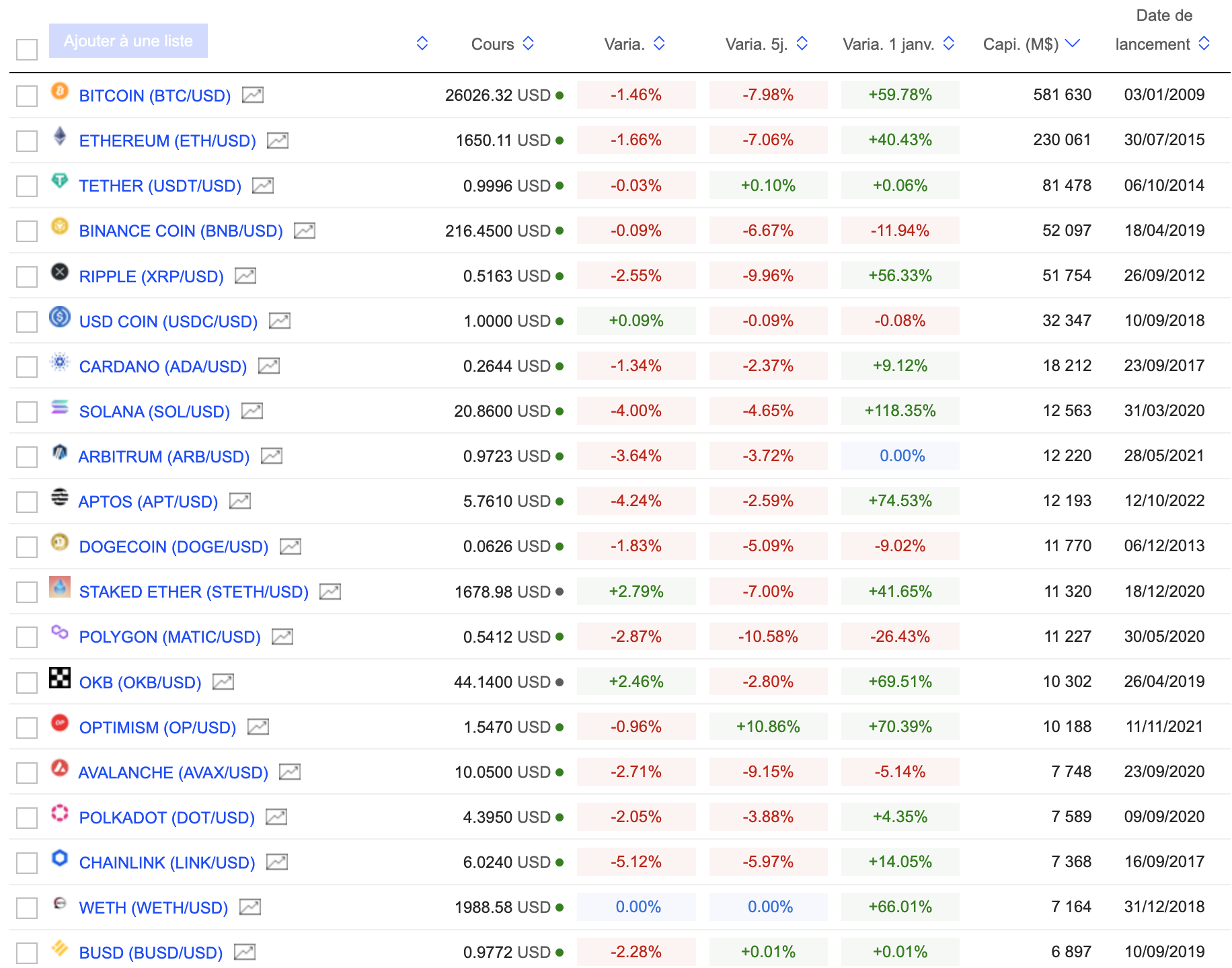

Block 3 : Gainers & Losers

Block 4 : Things to read this week

Fraudsters used ChatGPT to release a crypto botnet on X (Wired)

SBF was advised by FTX's lawyers (WSJ)

Victims of NFT startups are piling up (The Informations,)

By

By