Talking Points

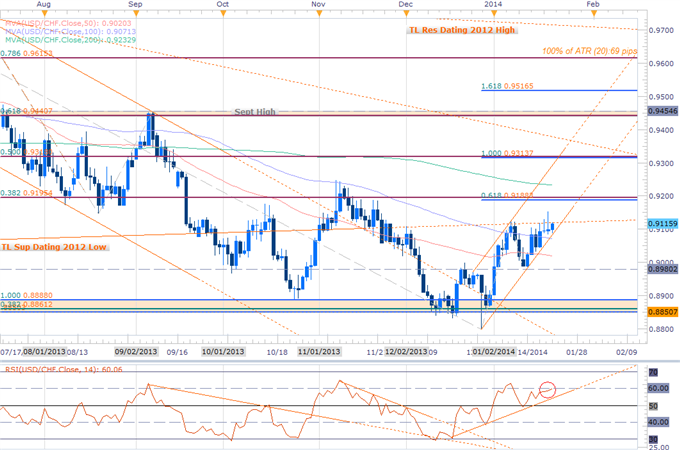

- USDCHF stalls after achieving primary targets- 9153 resistance

- Weekly opening range in focus- Break to validate near-term scalp bias

- Broader outlook remains weighted to the topside above 8980

USDCHF Daily Chart

Chart Created Using FXCM Marketscope 2.0

Broader Technical Outlook

- USDCHF achieves all three resistance objectives- 9153 resistance in focus (weekly high)

- Primary objective 9188/98- Subsequent resistance targets at 9232 & 9313/16

- Break sub weekly range low / Fib support at 9077/84 invalidates bullishscalp bias

- Broader outlook remains weighted to the topside above- 8980

- Momentum testing 60- Breach to validate bias

- PendingRSI support trigger takes us out of long exposure

- Event Risk: US Existing Home Sales on Tomorrow

USDCHF Scalp Chart

Notes: Half of our long exposure was booked at 9150 in DailyFX on Demand on Tuesday morning with the remainder of the trade getting stopped out on the move sub-9120. A brief break below trendline support dating back to the December lows was quickly recovered in pre-market trade today and our scalp bias continues to favor the topside while above the 9077/83 support region.

Note that the momentum signature has broadly held above the 40-theshold (supportive) and a breach above the weekly range high with RSI conviction puts us back on track with our initial objective eyed at 9188/98.

We will respect a break below the weekly range low with such a scenario invalidating our near-term bias and puts support targets into view at 9045 & 9024. Bottom line: the broader outlook remains constructive above 8980/88 and we will look to buy dips/breaks of resistance while above this threshold.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

Entry/Exit Targets | Timeframe | Level | Significance |

Resistance Target 1 | 30min | 9120 | Soft Resistance / Pivot |

Bearish Invalidation | 30min | 9153 | 78.6% Retracement / Weekly ORH |

Break Target 1 | Daily / 30min | 9188/98 | 61.8% Ext / 38.2% & 88.6% Retraces |

Break Target 2 | Daily | 9233 | 200DMA / (Nov High at 9249) |

Break Target 3 | Daily / 30min | 9313/18 | 100% Ext / 50% Retracement |

Bullish Invalidation | Daily / 30min | 9077/84 | 61.8% Retrace / Weekly ORL / TL Support |

Break Target 1 | 30min | 9045 | Soft Support / Pivot / Last Week’s ORH |

Break Target 2 | 30min | 9020/24 | 50% Retrace / Jan 2nd Swing High / 50DMA |

Break Target 3 | Daily / 30min | 8980/88 | Jan 2nd Close / Last Week’s ORL / Pivot |

Break Target 4 | 30min | 8935 | 61.8% Retracement |

Average True Range | Daily (20) | 69 | Profit Targets 17-19pips |

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

- EURUSD Bias At Risk Above 1.3522- Weekly Opening Range in Focus

- AUDCAD Scalps Target Key Support- Bias Bearish below 9746

- Scalping EURNZD Correction- Bias Bullish Above 1.6154

- EURAUD Scalps Eye Channel Breakout- Bias Bullish above 1.5020

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for a Live Scalping Webinar this week on Thursday morning on DailyFX Plus (Exclusive of Live Clients) at 1230 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

original source

By

By