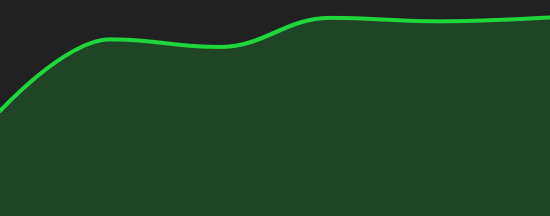

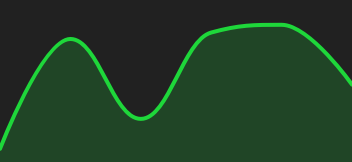

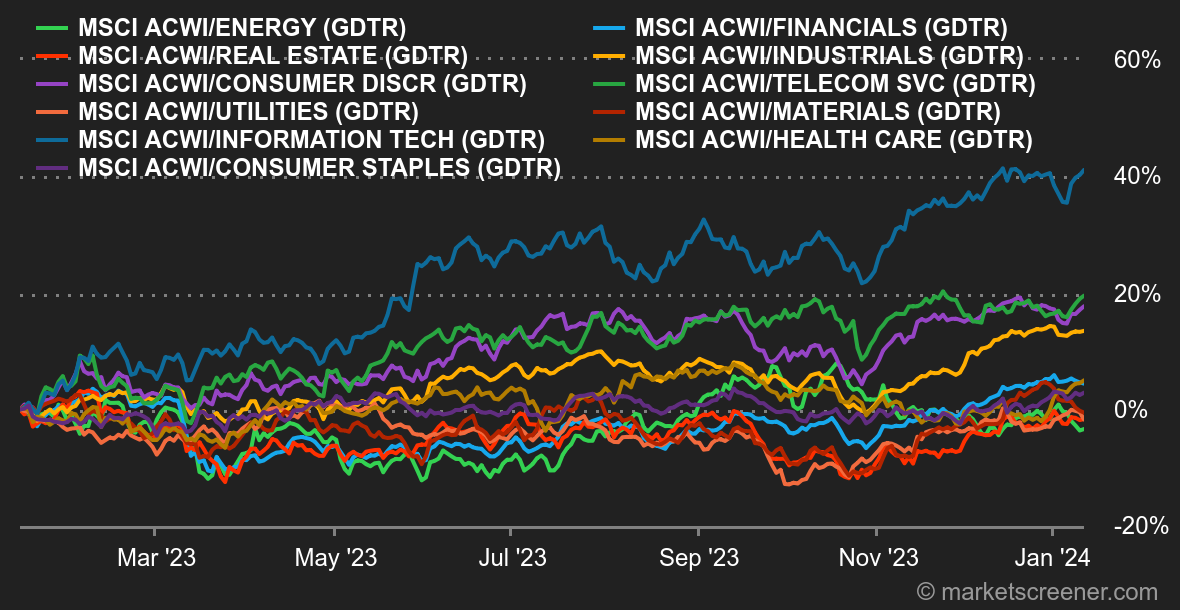

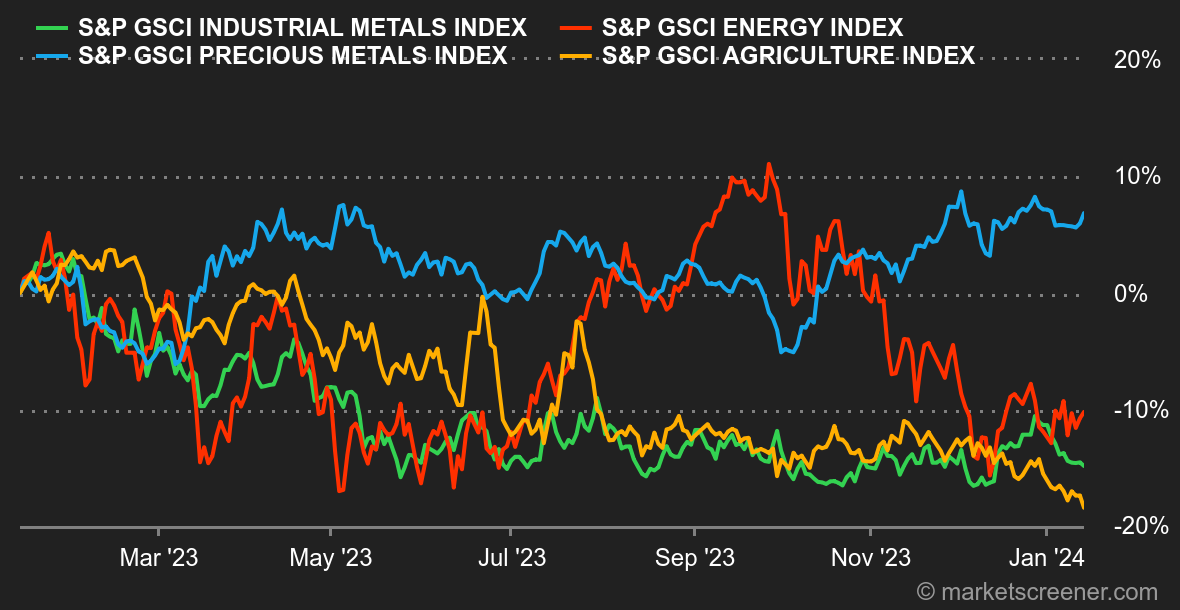

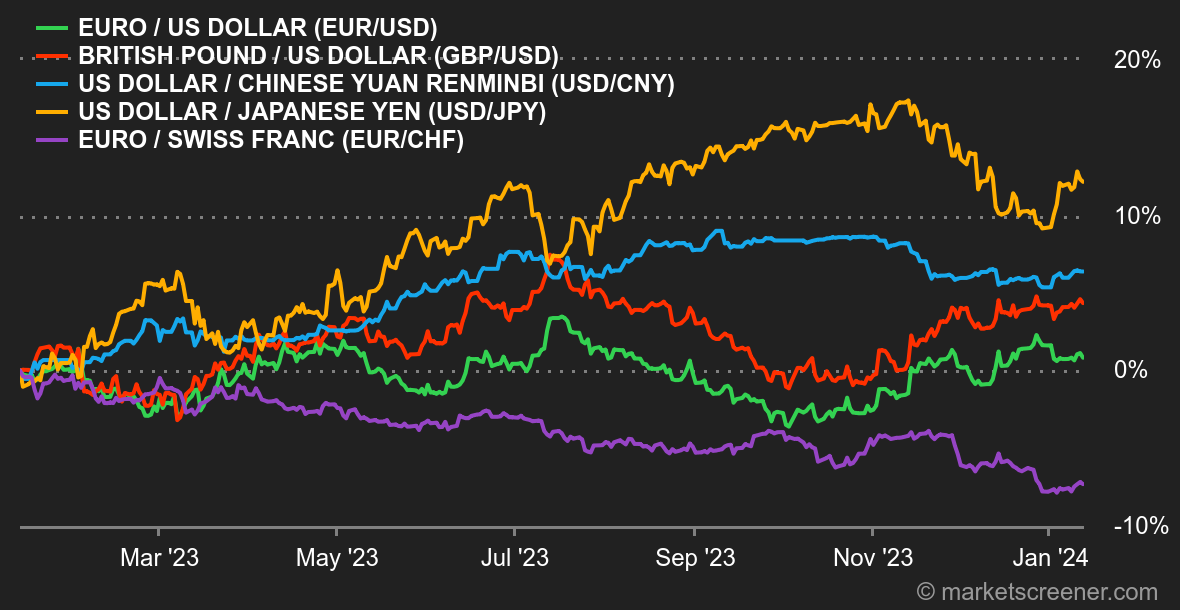

- Atmosphere: The slowdown in inflation is one of the pillars of the current narrative, which should enable the Fed to lower its key rates, ideally as early as next March. The publication of a slightly higher-than-expected consumer price index was cause for concern. In December, the CPI came in at +3.4% year-on-year against a forecast of +3.2%, while the "Core" version (excluding energy and food) stood at +3.9% against a forecast of +3.8%. After an initial negative reaction, stock market indices managed to recover, particularly during the US session, while the yield on the US 10-year bond held below the technical threshold of 4.07%. Investors therefore continue to bet on monetary policy easing in the short term, while having mourned the prospect of a rapid economic recovery in China.

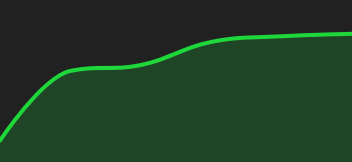

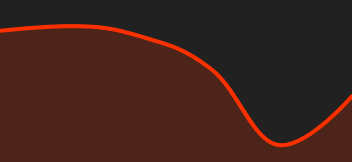

- Crypto: The news that has been stirring the cryptosphere this week is, of course, the decision by the SEC, the US financial markets regulator, to approve Bitcoin Spot ETFs, i.e. the marketing of exchange-traded funds backed directly by Bitcoin. After years of refusal, and at the request of several asset management companies, including behemoths BlackRock, Invesco and Fidelity, the regulator finally gave the go-ahead for the launch of 11 products. An agreement that left a bitter taste in the mouth of Gary Gensler, head of the institution, as he declared in the aftermath: "We neither approve nor support Bitcoin". Nevertheless, this "institutionalization" of Bitcoin trading opens the door to widespread popular investment in the crypto-king.

|

By

By