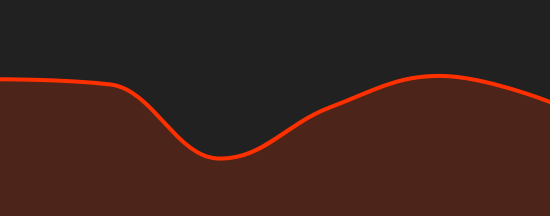

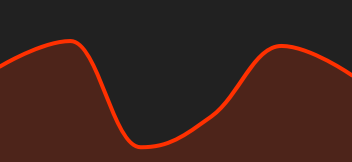

Gainers:

- Lyft (+46%) & Uber (+15%) are back in the black. Uber reported its first-ever annual profit in 2023, at $1.9 billion. It also unveiled a bright outlook and announced a $7 billion share buyback. Lyft, after rising on a publication error this week, nevertheless confirmed its rise by reporting a sharply reduced loss in Q4 2023, positive EBITDA, sales up 4% and booking volume up 17% over the period. However, drivers from both companies went on strike yesterday to demand better pay conditions.

- Super Micro Computer (+36%): The rally in US technology companies linked to artificial intelligence shows no signs of abating. The assembler, which is largely benefiting from the trend, has set new all-time highs every day this week. It has gained 253% since the start of the year (yes, you read that right) and 1134% since January 2023 (yes, here too).

- Diamondback Energy (+18%): The oil producer has signed a merger agreement with privately-owned Endeavor Energy Resources, for $26 billion. This combination will create a new energy behemoth, expected to be valued at at least $50 billion, and armed to compete with other industry giants such as ConocoPhillips. The market applauds.

- Coinbase (+17%) & Robinhood Markets (+16%): Cryptocurrency brokerage platforms are benefiting greatly from the strength of Bitcoin, which this week surpassed the $50,000 threshold. Coinbase also delighted investors by returning to profit in Q4 of fiscal 2023 and posting quarterly sales up by over 50%. A similar situation for Robinhood, which posted solid, better-than-expected quarterly results, a surprise profit for the period and assets under custody up 65% for the year.

- Arm (+16%): Like Super Micro Computer, UK-based ARM is benefiting from investors' frenzy for artificial intelligence. This week, the chipmaker's share price soared again following an announcement by industry leader Nvidia, which revealed that it had taken a position of nearly $150 million in the British group. ARM also raised its annual sales estimate. The stock has gained over 90% since the start of the year.

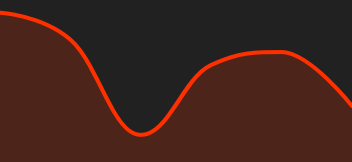

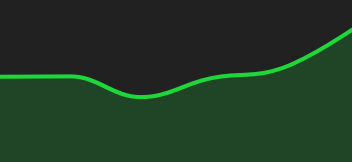

Losers:

- Avis Budget (-28%): The car rental company fell after publishing disappointing results for Q4 2023. Earnings per share came in at $7.1, down sharply on the previous year's figure of $10.1, while sales were down slightly, and below market expectations. It should be noted that the punishment is severe, as annual sales hit a record high, and rental volumes were up.

- Twilio (-15%): The cloud communications software maker did better than expected last quarter, with sales of $1.1 billion, but it cooled the markets by announcing a slowdown in future growth and a decline in revenues It also expects higher expenses in the current quarter.

- West Pharma (-14%): The pharmaceutical equipment manufacturer did not fall short of expectations. Its sales grew by 10% in 2023, and its gross margin and profit increased in the last quarter. However, the US group unveiled timid forecasts for 2024: its adjusted earnings and net sales outlook missed market expectations.

|

By

By