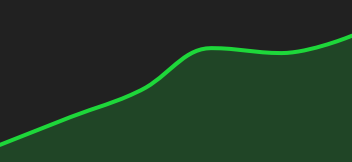

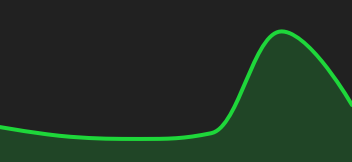

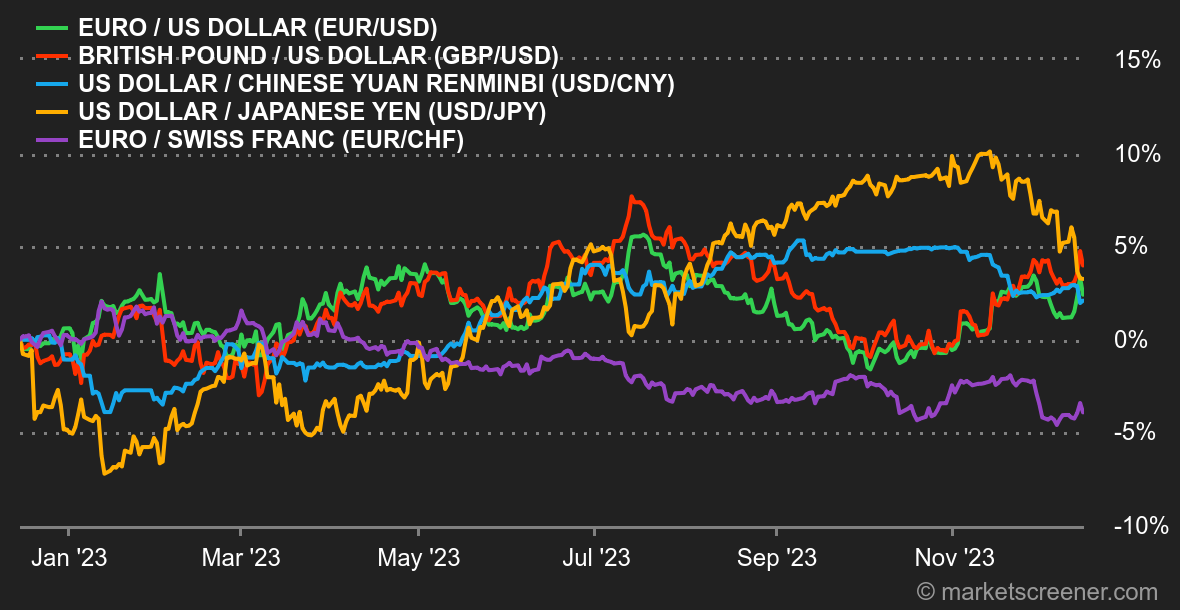

- Atmosphere: Happy Ending. This year, the market decided to play Santa Claus early. For the final act of 2023, the Fed pulled out all the stops. Even the most optimistic wouldn't have dared dream of such a spectacle. The members of the Monetary Policy Committee have singularly modified their positions since last September. Goodbye high rates, hello easy money! If the scenario unfolds without a hitch, the Fed could cut its key rates by 75 basis points in 2024. A boon for equity markets... Meanwhile, the easing continues, with the yield on the U.S. 10-year bond having just fallen back below the symbolic 4% threshold after flirting with 5% at its peak. Let's hope it lasts! Among the indicators published this week, we saw weakness in European PMIs, which suggests that the ECB, despite its more combative attitude than expected, may have to consider a rate cut soon. US statistics, meanwhile, remain resilient. In China, data continues to blow hot and cold.

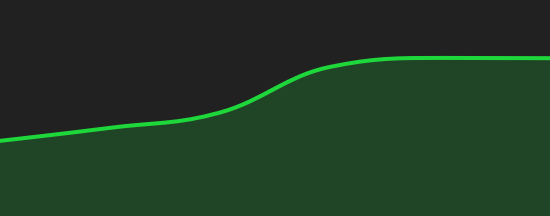

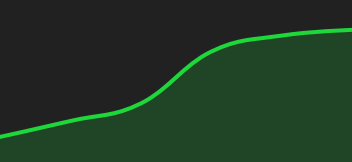

- Crypto: After eight consecutive weeks of gains, bitcoin has fallen by 2.5% since Monday, dropping back below the $43,000 mark at the time of writing. In its wake, ether, the native cryptocurrency of the Ethereum blockchain, is also retreating, falling back to around $2250, down 3.8% this week. After gaining over 56% in just two months, a good number of crypto-asset market players are taking profits on BTC, which may explain this week's slowdown. Meanwhile, the most eagerly awaited event remains the approval of a Bitcoin Spot ETF by the US Securities and Exchange Commission (SEC). Many industry experts believe that the first potentially positive responses from the SEC on these exchange products will come early next year. Enough to keep aficionados of the digital currency industry languishing over the festive season.

|

By

By