Technavio has announced the top five leading vendors in their recentglobal military satellite payloads and subsystems market report until 2021. This research report also lists five other prominent vendors that are expected to impact the market during the forecast period.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170111005474/en/

Technavio has published a new report on the global military satellite payloads and subsystems market from 2017-2021. (Photo: Business Wire)

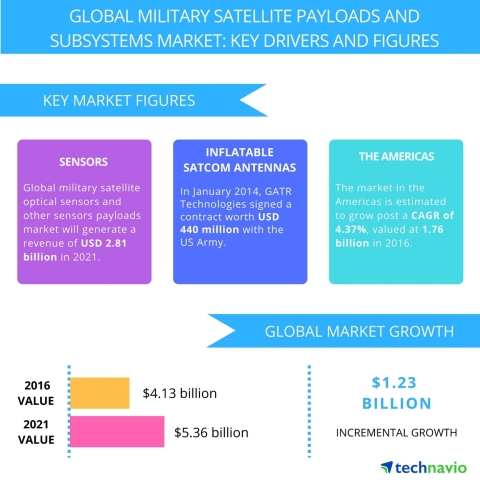

The global military satellite payloads and subsystems market occupies a majority, accounting for about 59% of its parent market, which is the global military satellite market. It is projected to be valued at USD 5.35 billion by 2021, growing at a CAGR of over 5% through the forecast period. Geographically, the Americas occupy the largest market segment with a share of over 42%.

“Owing to the changing nature of warfare, military agencies are increasingly becoming dependent on satellite-based supports to ensure mission effectiveness. Additionally, the adoption of unmanned aerial vehicles (UAVs) and modern equipment is also swiftly increasing among military forces. Such developments are providing enormous opportunities to manufacturers of satellite payloads to offer advanced, lightweight, and next-generation systems and subsystems, which can provide cost-effective solutions to military operators,” says Moutushi Saha, one of the lead analysts at Technavio for defense research.

Competitive vendor landscape

The global military satellite payloads and subsystems market is highly competitive, where vendors compete on cost, the weight of satellite components, technological advancements, and reliability parameters to gain a market edge. To flourish in this competitive environment, vendors continually optimize their product development processes to provide cost-effective and high-quality products and solutions.

It is also imperative that vendors cooperate and work together with prime integrators of satellites, space launch system developers, and service providers to provide quality service to consumers. The growing concerns over the hazards of space debris will lead to deorbiting systems in miniaturized satellites. Vendors who can adopt in the constantly evolving environment will see high returns on their investments in this market.

Request a sample report: http://www.technavio.com/request-a-sample?report=55482

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Top five vendors in the global military satellite payloads and subsystems market:

Airbus Defence and Space

Airbus Defence and Space offers products and services in the space, military aircraft, missiles, and associated systems sectors. The company designs and manufactures space platforms and associated electronic components. In 2014, the company joined the BEACON project that focuses on developing key photonic technologies for next-generation satellites. Presently, the company is studying the feasibility of using terrestrial photonics and fiber optic technologies with the aim of enhancing the capacity on high throughput communication satellites.

Boeing

Boeing, along with its subsidiaries, engages in the aerospace and defense businesses across the world. In 1995, Boeing introduced its first 702 spacecraft family for commercial and military applications. By the end of 2010, the company sold 28 of 702 satellites, and those had accumulated over 867,000 hours of service life in both military and commercial applications. The company introduced a variant of 702 satellite under the name of Boeing 702SP (small platform) in 2012. In the subsequent year, the Boeing 702SP cleared the critical design review.

Honeywell International

Honeywell International provides aerospace products and services; electronic and advanced materials; turbochargers, control, sensing, and security technologies; and energy-efficient products and solutions for business, homes, and transportation industries globally. The company manufactures satellite microelectronics, including navigation, control, and guidance-related products used in military satellites. The company also offers communication subsystems that enhance the communication and sensing capability of military satellites.

Lockheed Martin

Lockheed Martin engages in the R&D, production, and supply of advanced technology systems, products, and services to global defense and aerospace industries. The company manufactures satellite communication and radio frequency payloads for both commercial and military satellites. These payloads are used in various applications, including national intelligence, commercial broadband services, and protected communications for military ground forces. In July 2014, the USAF had selected the company for the supply of hosted payloads like electronics and sensors for supporting specific military missions.

Thales Group

Thales Group provides solutions primarily to the aerospace and defense industries globally. The company, primarily through its subsidiary Thales Alenia Space, designs and manufactures military satellites and payloads. It integrates and deploys various space systems that are used for the defense, security, and commercial applications.

The company stands as one of the major contractors for military communication satellites of the armed forces of France. The company also provides secure satellite communication services to various countries, including the North Atlantic Treaty Organization (NATO) members, through its SYSTEM 21 solutions. It provides ground station and mobile transmission solutions for air, land, and naval platforms such as UAVs, armored vehicles, helicopters, surface ships, and submarines.

Browse Related Reports:

- Global UAV Payload and Subsystems Market 2017-2021

- Global Satellite Manufacturing and Launch Market 2016-2020

- Global Satellite Transponder Market 2016-2020

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like space, defense technology, and aerospace. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170111005474/en/