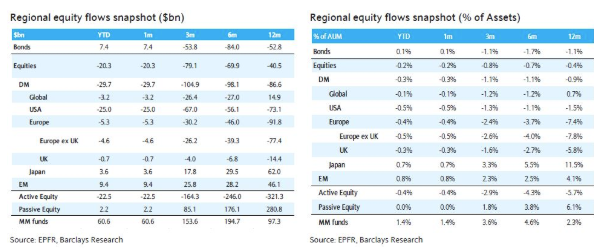

Equity markets may have rebounded since the beginning of the year, but fresh money continues to come out. This paradoxical situation has been noted by Barclays Bank, even though it should not be generalized. The two tables below show that volumes remained negative in the United States and Europe in January, that Japan and Emerging Countries continued to attract funds. Not surprisingly, bond and money market funds are still on the rise, as they are a low-risk alternative when equity markets are rocking. The table on the left measures the amounts and the table on the right measures the proportions.

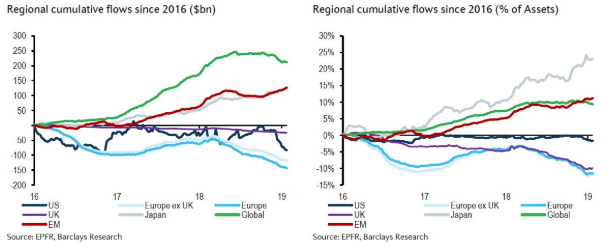

To put the data from the two previous tables into perspective, Barclays produced two graphs showing the cumulative flows since 2016 in amounts (left) and percentages (right). The Europeans are in a bad situation and the Japanese are surprisingly dashing.

Click to enlarge

Barclays' in-depth analysis with the above-mentioned data and other indicators tends to show that equities are no longer "oversold" as they may have been just a few weeks ago, but that the allocation remains cautious, with a marked preference of investors for bonds and cash. However, as the rise in equities is in contradiction with flows, the latter should improve in the coming weeks, the bank predicts, because flows are often lagging behind market movements.

As for sectoral allocation, it remains favorable to cyclicals even if the "overweight" continues to decline. The graph below captures the trend since the subprime crisis. Defensive measures remain "underweight", while financials are back below average. Among European funds, industrial companies remain the most popular, even if the medium-term trend is downwards. At the other extreme, basic consumption is the most "underweight" in portfolios.

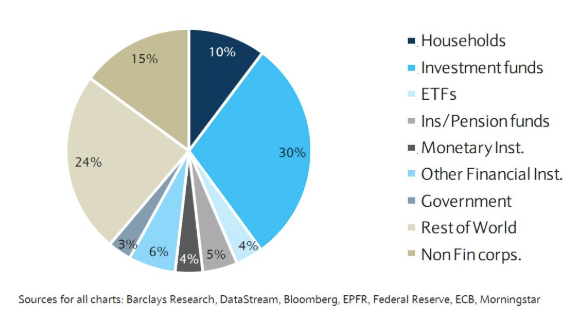

To finish this overview at the end of January, who owns what on the European equity markets? According to data collected by Barclays, investment funds own 30% of the market, while ETFs (passive management) reach 4%. In the United States, the former are at 23% and the latter at 5%.

By

By