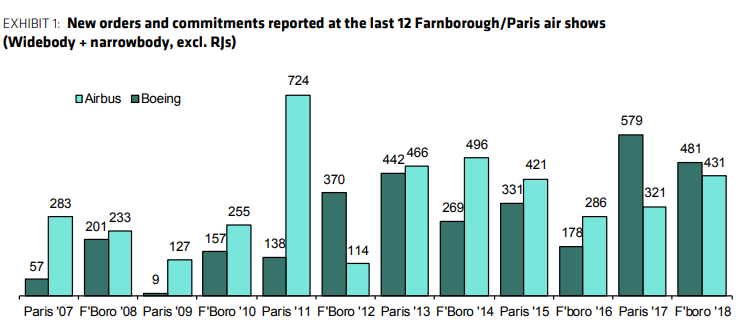

There were a total of 912 new orders at Farnborough this year, just surpassing last year’s 900 at the Paris airshow. Over the past five years, Airbus has captured more firm orders than Boeing. However, Boeing caught up over the course of the first half of this year, having booked 460 net firm orders, compared with just 206 for Airbus.

Chart to show new orders and commitments reported at the last 12 Farnborough/Paris air shows. Source: Company reports, press reports, FlightGlobal, Bernstein analysis.

The show at a glance

Although Airbus had a solid week, it must be recognized that most of the deals it announced were commitments which need to be finalized – as appose to firm orders. The company reported 93 firm orders and 338 additional commitments at this year’s airshow. Airbus now needs to focus on converting these commitments into firm deals over the next couple of months. Airbus reconfirmed its 66 A330neo orders with AirAsia adding 34 more. This diffuses tensions that AirAsia could defect to choosing the Boeing 787, while also helping assure a longer-term life for the A330neo. Finally, the certification of the A350 in China, has eliminated the Chinese delivery barrier and Airbus will continue to focus on executing A350 ramps.

Boeing also reported a strong number of orders at Farnborough, ending the show with an edge over Airbus in regards to firm orders. Boeing saw large demand for its 737 MAX, with a total of 404 firm orders and commitments. This compared to 304 orders for Airbus’s equivalent aircraft, the A320neo. Although Boeing’s short haul offering received more orders at Farnborough, we still see the narrow body market as being fairly evenly split. Douglas Harned of Bernstein Research suggested that Boeing’s New Midsize Aircraft (NMA) may be slipping, after CEO Muilenburg indicated it would now be starting in 2019. He believes a 2019 launch may also make a 2025 entry into service more difficult and Boeing’s potential switch to a metal fuselage design for its NMA, due to costs, would arguably eliminate certain conceptual advantages. These concerns although important should not overshadow Boeing’s strong order haul at this year’s airshow which gives them a strong opportunity at surpassing 1,000 net firm orders in 2018, a record it hasn’t broken since 2014.

The challenges of optimizing the supply chain

Both companies have made positive comments about the current market. Boeing says its order total reflects ‘resurgence in demand for freighters and strong order activity for the 737 MAX and 787 passenger airplanes’ whilst Airbus says it saw ‘strong market appetite for all our leading aircraft product families’.

A strong market is a bonus for the orderbook. However, raising production rates must be a priority going forward. By next year, Airbus hopes to be making 63 A320-family aircraft per month, while Boeing hopes to be making 57 737 family aircraft per month. Both manufacturers recognize the risk of losing orders unless they can increase production rates. However, supply chain capacity is a key area of concern. This is particularly true for engine makers which are currently struggling to meet existing production targets. Douglas Harned also indicated that there are no new issues on the GTF or LEAP engines but delays for LEAP deliveries on the A320neo appear to be 3 weeks longer than on the 737MAX. Furthermore, Rolls-Royce’s Trent 1000 engines are still proving troublesome but the firm believes it is resolving the issues.

Farnborough 2018 has proven to be a strong airshow for both Airbus and Boeing with the latter now needing to focus on firming up commitments over the next few months and raising production targets. Supply chain issues will remain a concern, notably in regards to engine manufacturers, and should not be ignored. Finally, the risk of an open trade war between the United States and China should not be forgotten as that could derail a robust aeronautical cycle.

NB: Boeing Q2 earnings release on July 25th and Airbus Q2 earnings release on July 26th.

Written by Benjamin P.

By

By