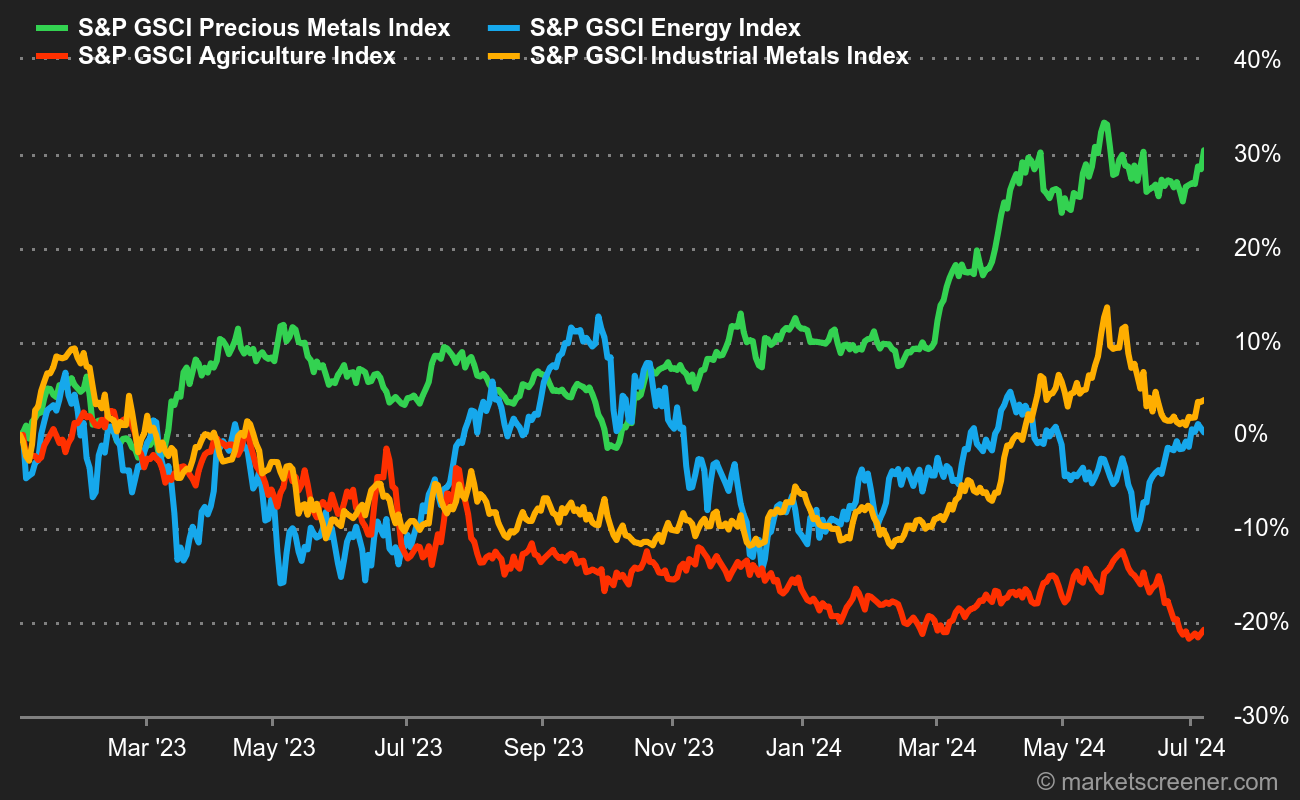

Energy: Oil continues to rise. Geopolitical tensions continue unabated in the Middle East, where observers fear a spread of the war to Lebanon. Several countries, including Germany, have asked their nationals to leave the country. These frictions are underpinning crude oil prices and overshadowing the dynamics of US inventories, which rose by 3.6 million barrels at Cushing, whereas the consensus was for a fall. As far as explanations are concerned, the fall in US exports partly explains the upturn in inventories, while at the same time, US refinery activity is tending to contract, a rather worrying sign for the state of US demand for refined products. In terms of prices, Brent crude is trading up at around USD 86.60, while WTI is trading at around USD 83.

Metals: Copper continues its decline on the London Metal Exchange, trading not far from the USD 9600 cash price line. The rising dollar and, above all, the absence of bullish catalysts are weighing on the industrial metals segment as a whole. Still in London, aluminum is slowly slipping towards USD 2515. Gold, meanwhile, is treading water at around USD 2330.

Agricultural commodities: Cocoa prices are correcting, as wildly as ever, having fallen 15% last week. Improved weather conditions in Ghana and Cameroon are easing fears of a global supply deficit. Nevertheless, a tonne of cocoa is still up 80% since January 1st.

By

By